Execution Transparency

At ICM Capital, our aim is to give you all the information you need to make smarter trades. We understand that in today’s complex market environment, transactional transparency is an increasingly important part of execution performance. The more transparent your trading partner, the more you know and the more power you have.

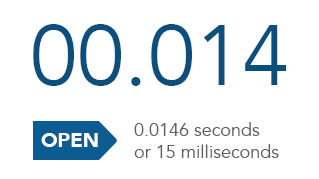

EXECUTION SPEED

Execution affects the price you pay. ICM Capital is therefore committed to maintaining an efficient trading environment and understands that fast trade execution* is critical to your success. We challenge ourselves every day to deliver this. After all, being fair pays dividends in customer satisfaction.

Standard Account Type

* This is defined as the time frame between when the order is received and when the order is executed. This excludes internet latency and post trade booking. The data is based on Forex pairs, and Metals only.

Data from 1st of December to the 20th of December 2020.

PRICE IMPROVEMENTS

At ICM Capital, we've automated every aspect of the trade process with the goal of ensuring your trades are executed lighting fast, without any manual intervention, and at the price you expect – or at times even better.

Our Technology: Over one hundred thousand orders with Price Improvements

With ICM Capital’s price improvement technology, all orders can receive positive slippage, or price improvements as a result of natural market price fluctuations. This means you can potentially make more money if the market gaps or spikes favourably through your price. This is especially true in situations where the market moves fast (during weekend gaps or around news events). You may though also experience negative slippage. This means the price you are filled at will be worse than the order price and in extremely volatile markets, the fill price could be much worse. However, we're committed to maintaining an efficient trading environment that reduces latency to help you manage the degree of acceptable slippage.

ICM Capital Highlights

- 67.38 % of all orders had NO SLIPPAGE.

- 17.39 % of all orders received positive slippage.

- 15.23 % of all orders received negative slippage.

| RTS 27 Publication | |||

|---|---|---|---|

| Q2 - 2019 | April 2019 | May 2019 | June 2019 |

| Q3 - 2019 | July 2019 | August 2019 | September 2019 |

| Q4 - 2019 | October 2019 | November 2019 | December 2019 |

| Q1 - 2020 | January 2020 | February 2020 | March 2020 |

| Q2 - 2020 | April 2020 | May 2020 | June 2020 |

| Q3 - 2020 | July 2020 | August 2020 | September 2020 |

| RTS 28 Publication | |

|---|---|

| Annual 2021 | |

| Annual 2022 | |

DISCLAIMERS

The information illustrated on this page is historical in nature and does not imply that ICM Capital maintains a particular capacity or performance level. Past results are not indicative of future performance.